Blackstone (BX)·Q4 2025 Earnings Summary

Blackstone Caps Record Year With $71B Inflows as AUM Hits $1.275 Trillion

January 29, 2026 · by Fintool AI Agent

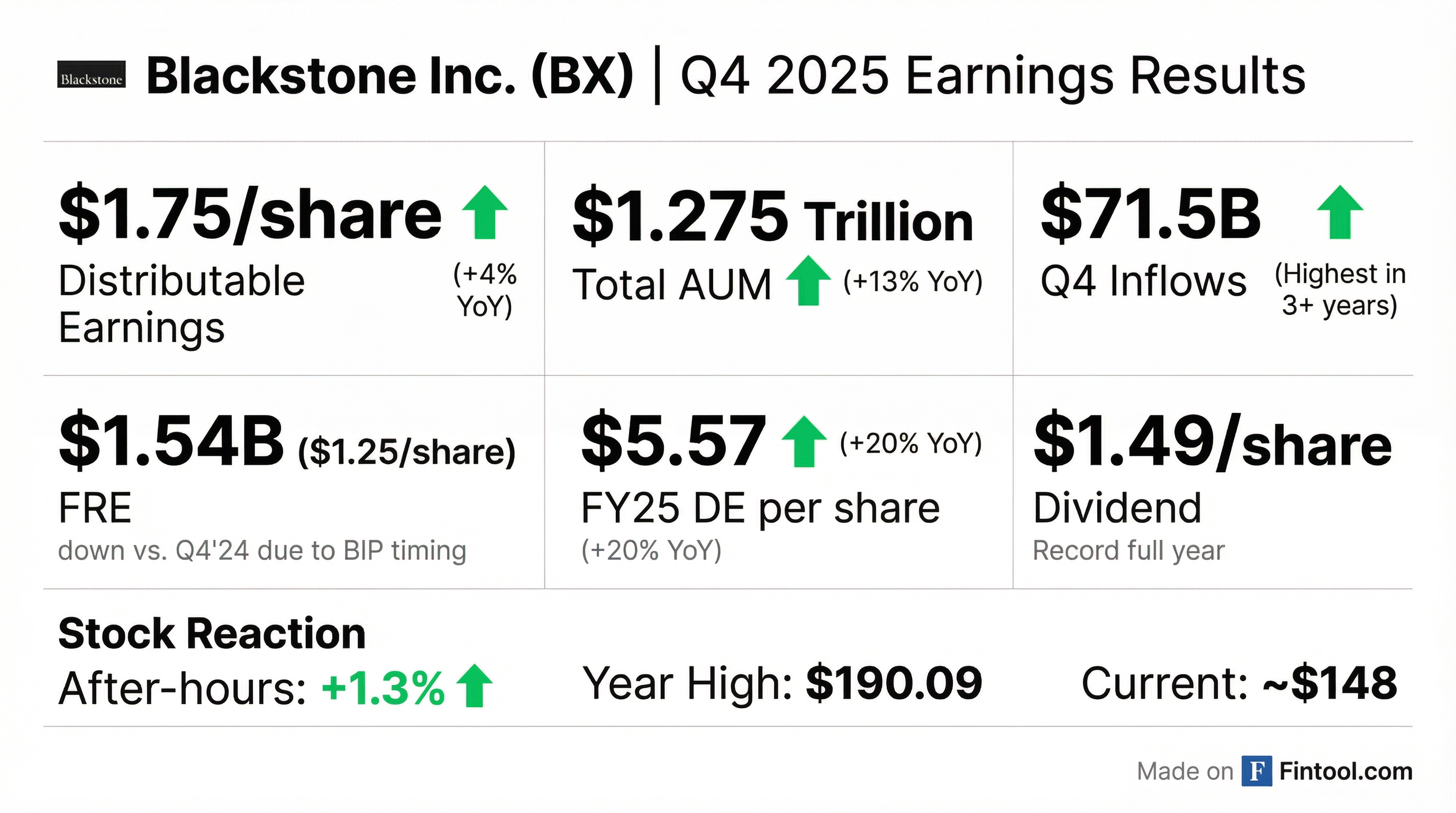

Blackstone delivered its strongest quarterly inflows in over three years, raising $71 billion in Q4 2025 and pushing total Assets Under Management to a record $1.275 trillion . The world's largest alternative asset manager reported Distributable Earnings of $1.75 per share — "the best results in our 40-year history" — capping a record year with full-year DE up 20% to $5.57 per share .

CEO Steve Schwarzman highlighted three powerful dynamics converging: an accelerating deal environment, generational AI investment opportunities, and deepening private markets adoption. President John Gray added: "This is an exciting time for Blackstone" .

Did Blackstone Beat Earnings?

Blackstone's Q4 2025 results exceeded expectations on most key metrics:

Note on FRE decline: The 16% decrease in Fee Related Earnings is due to timing of BIP (Blackstone Infrastructure Partners) fee-related performance revenues, which generally crystallize every three years. Excluding BIP's Q4'24 crystallization, FRE grew 24% YoY .

For the full year, the picture is unambiguously strong:

How Did the Stock React?

Blackstone shares opened up 2.3% at $150.23 following the earnings release but sold off during the session, closing at $141.78 (down 3.4%). The stock touched a low of $141.31 on volume of ~2 million shares.

The reversal suggests investors may be concerned about the broader market environment despite Blackstone's strong fundamentals. The stock trades at $141.78, down 25% from its 52-week high of $190.09 but well above its 52-week low of $115.66.

What Changed From Last Quarter?

Inflows Accelerated Dramatically

The $71.5 billion in Q4 inflows was the highest quarterly total in over three years, bringing full-year inflows to $239.4 billion . Key drivers:

- Credit & Insurance: $39.0B inflows (+$132.1B FY) — led by $16.6B in direct lending, $11.8B in infrastructure/asset-based credit

- Private Equity: $20.3B inflows (+$68.1B FY) — including $8.0B in Secondaries, $4.2B in Infrastructure

- Real Estate: $8.3B inflows (+$25.5B FY) — includes $935M BREIT raise

- Multi-Asset Investing: $3.9B inflows (+$13.6B FY)

AUM Segment Breakdown

Perpetual Capital reached $523.6 billion, up 18% YoY, representing 48% of Fee-Earning AUM . This high-quality, stable capital base is a key driver of Blackstone's FRE growth.

Private Wealth: Record Year With 53% Growth

Blackstone's private wealth fundraising grew 53% YoY to $43 billion in 2025, with the firm now commanding an estimated 50% market share of private wealth revenue across major alternative managers . Q4 private wealth sales exceeded $11 billion, up 50% YoY .

Investment-Grade Private Credit: The Next Growth Engine

Blackstone now manages $130 billion in IG private credit, up 30% YoY . Management believes this is "in the earliest stages" of a massive secular shift.

Why it's growing: (1) Corporate IG bond spreads at tightest since 1998 at 71bps, pushing insurers to seek yield, and (2) AI infrastructure build-out requires massive private debt for fabs, energy supply, and data centers .

Blackstone's "farm-to-table" approach — bringing clients directly to borrowers without origination/securitization friction — generated 180bps of incremental spread vs. comparably-rated liquid credits in 2025 .

What Did Management Guide?

Management provided unusually specific forward commentary on the Q4 call:

Fundraising Targets: Actively fundraising for five PE drawdown funds, targeting over $50 billion in aggregate — materially larger than predecessor vintages . All five expected to be fee-earning by year-end 2026.

IPO Pipeline: "One of the largest IPO pipelines in our history" with particular strength in U.S. corporates, energy/electricity picks-and-shovels, and India . The $7.2 billion Medline IPO was the largest sponsor-backed IPO ever .

2026 Product Launches: Expecting the "busiest year yet" for private wealth product launches, including:

- Vanguard/Wellington partnership products in H1 2026

- New hedge fund product (recently filed)

- 401(k) access expected 2027 following rulemaking in 2026

Management Fees: Base management fees expected to continue "strong positive trajectory" with real estate fees consistent with Q4 levels near-term, while PE/Credit/BXMA segments show 17% combined base fee growth .

FRE Margin: Starting point is "margin stability with the potential for upside" as operating expense growth continues decelerating .

Deployment: Deployed $138 billion in 2025 (highest in 4 years), planting seeds for future value . Nearly $200 billion of dry powder available .

Investment Performance Highlights

Blackstone's fund performance remained strong across strategies:

Standout: Infrastructure delivered exceptional returns with the dedicated platform growing 40% YoY to $77 billion . The BIP strategy has generated 18% net returns annually since inception 7 years ago. QTS data centers was again the largest single driver of returns for both BIP and real estate .

Credit Quality: Realized losses in Blackstone's $160B+ global direct lending portfolio were only 11 basis points over the last 12 months . Non-IG private credit strategies have generated 10% net returns annually over 20 years — double the leveraged loan market with minimal losses .

Capital Return to Shareholders

Blackstone declared a $1.49 quarterly dividend per share, payable February 17, 2026, to shareholders of record February 9, 2026 .

The dividend represents approximately 85% of Distributable Earnings, consistent with Blackstone's stated policy .

Balance Sheet Strength

In November 2025, Blackstone issued $600M of 5-year notes at 4.30% and $600M of 10-year notes at 4.95% .

Q&A Highlights From the Call

On the IPO Pipeline (Craig Siegenthaler, Bank of America): President John Gray emphasized that Blackstone has "one of the largest IPO pipelines in our history" with activity mostly concentrated in U.S. corporates, particularly energy and electricity-related businesses. He noted India will also see real estate IPO activity given underlying market health .

"It feels like 2013, 2014, where you had that four or five-year hibernation period, the markets reopened, and we took a bunch of companies public. That's the way it feels today." — John Gray

On AI Deployment (Michael Cyprys, Morgan Stanley): Gray discussed how Blackstone is deploying AI across the firm and portfolio companies. Key applications include making software engineers "twice as efficient" when coding, cyber monitoring, legal/compliance with Norm AI, and data summarization across their 270 companies and 13,000 properties .

On Private Credit Demand (Bill Katz, TD Cowen): When asked about competition from lower rates, Gray noted that BCRED's appeal isn't just absolute returns but relative returns and the premium Blackstone can generate. Institutional investors saw record credit fundraising in Q4 due to this premium, both in non-investment grade and investment grade .

On BCRED Flows (Alex Blostein, Goldman Sachs): Despite headline noise around private credit, BCRED raised $14 billion in gross sales for 2025, with $3.3 billion in Q4. Redemptions ticked up but Gray noted "the last two months, despite all of this, we've had $800 million of gross inflows each of the last two months" .

On Management Fees (Glenn Schorr, Evercore): CFO Michael Chae outlined five new PE drawdown fundraises targeting over $50 billion in aggregate, all expected to be fee-earning by year-end 2026 following investment period commencement in H1 2026 .

On 401(k) Opportunity (Mike Brown, UBS): Gray expects 2026 to be a "foundational year" with rulemaking, with capital raising more likely in 2027. On the Vanguard/Wellington partnership, he anticipates product launches in H1 2026 .

Key Risks and Concerns

-

Real Estate Recovery Remains Gradual: Opportunistic RE funds declined -0.6% for the year, though Core+ appreciated 3.0%. Management noted the recovery "won't be a straight line" with U.S. private real estate values still down 16% versus 75% gains in the S&P 500 since the rate cycle began .

-

FRE Timing Volatility: The 16% Q4 FRE decline illustrates how fee crystallization timing can create quarter-to-quarter volatility (BIP crystallizes every 3 years).

-

BCRED Redemptions: While gross sales remain strong, redemptions did uptick in Q4 amid broader private credit concerns. Management expressed confidence in portfolio health but acknowledged headline risk .

-

Valuation: At $141.78, BX trades at ~25x FY25 DE per share ($5.57), pricing in continued growth.

The Bottom Line

Blackstone delivered record results in 2025, with $239 billion in inflows driving AUM to $1.275 trillion and Distributable Earnings up 20% to $5.57 per share. Management's tone was notably bullish, with John Gray comparing the IPO environment to the 2013-14 reopening after a "four or five-year hibernation period."

Three structural tailwinds are accelerating: (1) the deal cycle has reached "escape velocity" as cost of capital moderates, (2) AI infrastructure is creating generational investment opportunities at scale, and (3) private markets adoption continues deepening across institutional, insurance, and individual channels .

With nearly $200 billion in dry powder, one of the largest IPO pipelines in firm history, and the busiest year yet planned for private wealth product launches, Blackstone is positioned to capitalize on the cyclical recovery while benefiting from secular growth in alternatives. The stock's 3.4% decline on earnings day may reflect broader market concerns rather than company-specific issues.

Related Links: